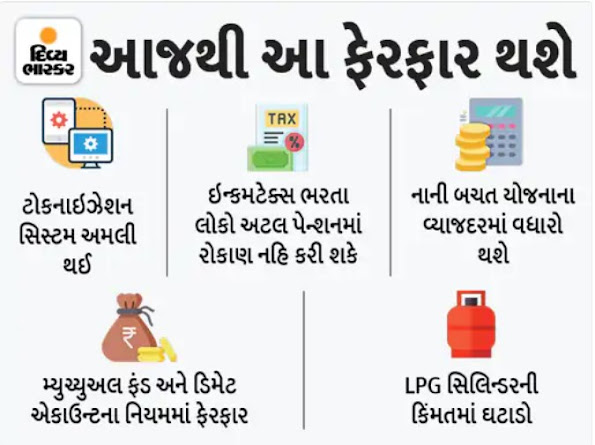

Change in interest rate of small savings scheme, implementation of tokenization system in payment, reduction in cylinder price

Today we will tell you about the 6 types of changes that have taken place since October 1

People paying income tax cannot invest in irrevocable pension

From 1 October i.e. from today, people paying income tax cannot avail the benefits of irrevocable pension. According to the current rule, any Indian person can invest between 18 years to 40 years whether or not he has filed income tax. Under this scheme, a pension of up to 5 thousand per month is given.

Tokenization system implemented

A tokenization system has been implemented for card payments from October 1. After the introduction of this system, merchants, payment aggregators and payment gateways will not be able to store any customer card information. The objective of the tokenization system is to prevent online banking fraud.

Usually there are many changes every month. From 1st October i.e. from today many changes have taken place in the country, which will directly affect your pocket. People who pay income tax cannot invest in Atal Pension Yojana. Apart from this, tokenization system will be implemented for card payments from today.

Nomination details are required to be given to those investing in mutual funds

Nomination details have to be given to people investing in mutual funds from October 1. If the nomination details are not given then a declaration has to be filled, the declaration has to inform about not availing the facility of nomination.

Asset Management Companies (AMC) have to provide option of nomination form or declaration form in physical or online mode as per the requirement of the investor. Under the physical option, the form will have the investor's signature, while in the online form, the investor can use the e-signature facility.

Increase in interest rate of Small Savings Scheme

The government has increased the interest on many post office small savings schemes. The interest rate on 2-year time deposits has been increased from 5.5% to 5.7%. Interest rate on 3 years time deposit has been increased from 5.5% to 5.8%.

The interest rate on Senior Citizen Savings Scheme has now increased from 7.4% to 7.6%. At the same time the monthly income account scheme will now fetch 6.7% annual interest instead of 6.6%. Apart from this, the interest rate on Kisan Vikaspatra has increased from 6.9% to 7.0%.

અહીંથી વાંચો સંપુર્ણ ગુજરાતી માહિતી રીપોર્ટ

Also changes in demat account rules

Demat account holders have to complete two-factor authentication by September 30, 2022. Only then you will be able to log-in to your demat account. If you do not do this, you will not be able to log-in to the demat account from October 1.

According to NSE, members have to use biometric factor as authentication to log-in to their demat account. The second authentication can be a 'knowledge factor', which can be a password, PIN or any factor.

Reduction in gas-cylinder prices

LPG gas-cylinder prices are reviewed on 1st of every month. According to the price announced by Indian Oil on October 1, the 19 kg commercial cylinder has become cheaper. In the capital Delhi, its price has come down from Rs 1,885 to Rs 25.50 to Rs 1859.50. In Kolkata, the price fell by Rs 36.5 to Rs. 1,995.50 to Rs. 1959.00 has been made.

1,844 in Mumbai at Rs. 35.5 down to Rs. 1811.50 and in Chennai Rs. 2,045 down to Rs. 36 down to Rs. 2009 is over. This is the sixth consecutive time that prices have fallen. There has been no change in domestic LPG cylinder prices. The price of a 14.2 kg gas-cylinder in Delhi is Rs 1053

No comments:

Post a Comment